Introducing Fundmate, the simple and user-friendly Notion template for micro VCs, solo GPs, and angels to track & manage the startup dealflow and portfolio. Say goodbye to complex and confusing investment management systems!

Wealthly is an anonymous investing community. You can see verified stocks, options, and crypto from other investors, and track all of your investments in one place. It's free and sign up takes 10 seconds. Please give us a try!

FinChat.io is your AI stock investing analyst. It is ChatGPT for Finance. With data on 750+ companies, 100+ super-investors, 10,000+ financial metrics and 10,000+ pages of investing material.

A collection of 3 interconnected databases in Notion that allows you to track your investment portfolio. Automatically synced with Yahoo!Finances data to provide you with real-time results. Control your finances from one hub inside the productivity app Notion.

TradeStation is a leading online trading platform that offers advanced tools and features to help traders make informed decisions in the financial markets. It is designed to provide traders with real-time market data, customizable charting tools, and a wide range of analytical tools to help them identify profitable trading opportunities. Whether you are a beginner or an experienced trader, TradeStation offers a powerful and user-friendly interface that makes it easy to trade stocks, options, futures, and forex. With its advanced technology and comprehensive trading resources, TradeStation is the ideal platform for traders who want to stay ahead of the curve and maximize their profits.

The Motley Fool Investment Service has introduced an AI-powered stock analysis tool that aims to help investors identify potential market-beating returns. This advanced tool uses artificial intelligence algorithms to analyze market data and provide insightful recommendations on stocks that have the potential to outperform the market. With its sophisticated technology and expert analysis, the Motley Fool Investment Service's AI-powered stock analysis tool presents a unique opportunity for investors to make informed investment decisions and maximize their returns.

Alien Genesys

AI Powered DNA Analysis

Craiyon

Craiyon, AI Image Generator

Copy.ai

Copy.ai: Write better marketing copy and content with AI

GPT-3 Alzheimer

Predicting dementia from spontaneous speech using large language models | PLOS Digital Health

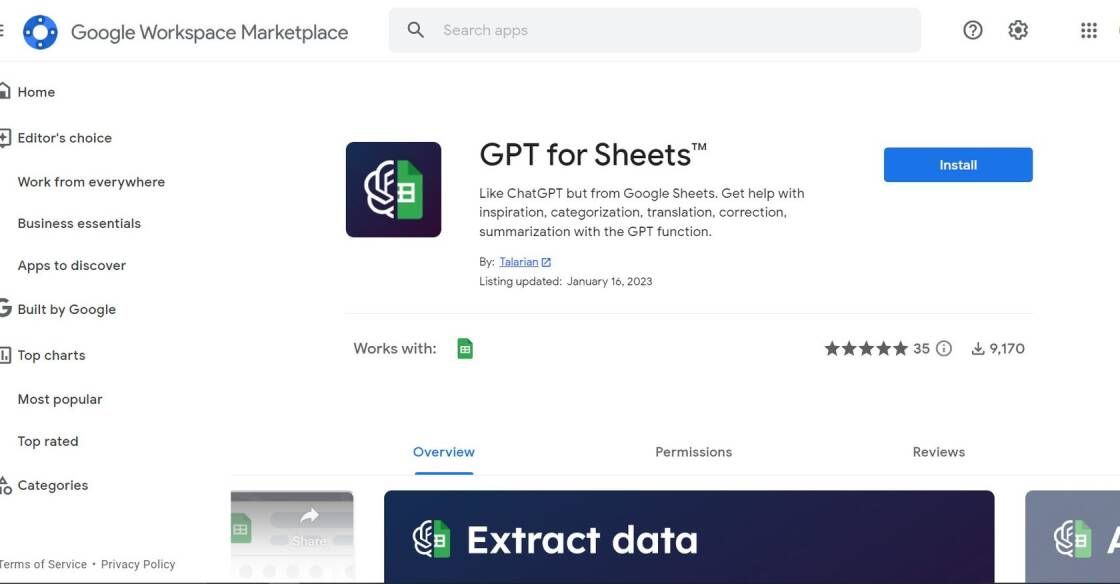

GPT For Sheets

GPT for Sheets™ and Docs™ - Google Workspace Marketplace

Speechify

Best Free Text To Speech Voice Reader | Speechify

Date Night Short Film

AI Generated Script: How We Made a Movie With AI | Built In

Erase.bg

Free Background Image Remover: Remove BG from HD Images Online - Erase.bg

Acorns is a revolutionary online investment app that has recently gained popularity, especially among millennials who are looking for an easy and effective way to invest their spare change. This innovative platform allows users to link their debit or credit cards to their Acorns account, and every time they make a purchase, the app automatically rounds up the amount to the nearest dollar and invests the difference into a diversified portfolio of ETFs. With Acorns, even small purchases like a cup of coffee can translate into significant long-term savings.

The app's user-friendly interface and low minimum investment requirement make it accessible to a wide range of investors, including those who may not have considered investing before. Acorns also offers a variety of investment options, from conservative to aggressive portfolios, allowing users to tailor their investments to their risk tolerance and financial goals.

Overall, Acorns provides an innovative and convenient way to save and invest for the future, making it an excellent option for anyone looking to grow their wealth with minimal effort.

Acorns is an online investment app that rounds up your everyday purchases to the nearest dollar and invests the spare change for you.

First, download the Acorns app and create an account. Then, connect your bank account or credit card to start investing your spare change.

Yes, Acorns is a secure platform that uses bank-level encryption and is FDIC-insured up to $250,000.

Acorns offers a range of investment portfolios based on your risk tolerance and financial goals. These portfolios include a mix of stocks, bonds, and other assets.

Yes, you can withdraw your money from Acorns at any time without penalty.

No, Acorns uses a robo-advisor system to automatically invest your money in diversified portfolios.

Yes, Acorns charges a monthly fee of $1-$5 depending on the plan you choose.

Yes, you can set up automatic recurring investments to help grow your savings over time.

Yes, Acorns offers personalized investment advice through its robo-advisor system.

Yes, Acorns is a great option for beginner investors looking to start saving and investing their spare change.

| Competitor | Description | Key Features | Difference from Acorns |

|---|---|---|---|

| Robinhood | Investment app that allows users to trade stocks, ETFs, options, and cryptocurrencies | Commission-free trading, fractional shares, automatic dividend reinvestment | Offers a wider range of investment options than Acorns |

| Stash | Investment app that helps users build a personalized portfolio based on their goals and interests | Fractional shares, automatic investing, educational content and tools | Provides more customization options for users' portfolios |

| Betterment | Online investment advisor that offers personalized portfolios based on users' goals and risk tolerance | Tax-loss harvesting, automatic rebalancing, socially responsible investing options | Offers more advanced investment strategies and options |

| Wealthfront | Online investment advisor with a focus on passive, low-cost investing | Tax-loss harvesting, automatic rebalancing, high-interest cash account | Offers higher interest rates on cash accounts than Acorns |

| M1 Finance | Investment platform that allows users to build and automate a custom portfolio of stocks and ETFs | Fractional shares, automatic investing and rebalancing, no trading fees | Provides more control over the composition of users' portfolios |

corns is an online investment app that has revolutionized the way people save and invest their spare change. With Acorns, you can start investing with as little as $5, making it accessible to everyone. Here are a few things you should know about Acorns before you start using it.

1. How Acorns Works

The Acorns app connects to your bank account and automatically rounds up your purchases to the nearest dollar. The spare change is then invested in a diversified portfolio of low-cost ETFs (exchange-traded funds) based on your investment goals and risk tolerance.

2. Fees

Acorns charges a monthly fee of $1 for accounts with less than $5,000 and 0.25% per year for accounts with more than $5,000. However, students with a valid .edu email address can use Acorns for free for up to four years.

3. Investment Options

Acorns offers five different investment portfolios ranging from conservative to aggressive. Each portfolio is made up of a mix of ETFs that track different market segments such as large-cap stocks, small-cap stocks, international stocks, and bonds.

4. Additional Features

In addition to its core investment offering, Acorns offers several features to help users save and invest more. These include:

• Round-Ups Multiplier: Allows you to multiply your round-ups by 2x, 5x, or 10x to accelerate your savings.

• Found Money: A cash-back program that rewards you with money when you make purchases with Acorns' partners.

• Acorns Later: A retirement account that allows you to save for retirement and take advantage of tax benefits.

• Acorns Spend: A checking account linked to your Acorns account that offers fee-free ATM withdrawals, cashback rewards, and other perks.

5. Security

Acorns takes security seriously and uses bank-level encryption to protect your information. Additionally, all investments are held by a third-party custodian, not by Acorns, which provides an extra layer of protection.

In conclusion, Acorns is an excellent option for those looking to start investing with minimal effort and cost. It offers a range of investment options, additional features, and robust security measures to ensure your money stays safe.

TOP