This introduction delves into the world of SEC insights, where the exploration and analysis of numerous documents provide valuable information and support in making informed decisions. By extracting meaningful insights and enabling deep comparisons, this process sheds light on intricate aspects crucial for understanding and evaluating various entities. Through an objective lens, this study aims to unravel the complexities of multiple documents, unraveling the hidden connections and patterns within, propelling us towards a comprehensive understanding of the subject matter. The examination and interpretation of these insights allow for better decision-making, fostering transparency and efficiency in today's ever-evolving business landscape.

CardZap revolutionizes the way we connect professionally by offering a seamless platform to create and distribute personalised digital business cards. With CardZap, individuals can effortlessly establish a professional online presence and network with ease. This innovative solution simplifies the process of exchanging contact information, eliminating the need for physical business cards. By embracing this technology, users can stay ahead in a digitally-driven world, enhancing their networking capabilities and making lasting connections. CardZap empowers professionals to showcase their unique brand identity while saving resources and contributing to a more sustainable future. Join CardZap today and unlock endless opportunities to connect and grow your professional network.

Konfio is a fintech company that provides AI-powered financial services platform to small businesses in Mexico. It offers an innovative solution that allows entrepreneurs to obtain small business loans without the need for collateral or paper processes. By leveraging the power of artificial intelligence, Konfio aims to democratize access to credit and facilitate the growth of small businesses in the country. With its user-friendly interface and streamlined process, Konfio has become a popular choice among small business owners who are looking for a quick and hassle-free way to secure funding.

Xero is a cloud-based accounting software designed to cater to the financial needs of small businesses. With its user-friendly interface and wide range of features, Xero has become a popular choice for small business owners looking to manage their finances efficiently. The software allows users to track expenses, invoice clients, reconcile bank transactions, and generate reports in real-time. Xero's powerful tools and automation capabilities make it an ideal solution for startups and growing businesses that need to streamline their accounting processes. In this article, we will explore the features and benefits of Xero and how it can help small businesses stay on top of their finances.

Small businesses often struggle to manage their finances efficiently and effectively. This is where a manager - small business accounting software comes into play. With the help of this software, small businesses can automate their financial tasks, track expenses, create invoices, and generate financial reports. This not only saves time but also reduces the risk of errors and fraud. In this article, we will discuss the benefits of using a manager - small business accounting software and how it can help small businesses grow and succeed.

Rose.ai is a revolutionary platform that empowers users to efficiently find, engage with, visualize, and share data. With its advanced features and intuitive interface, Rose.ai makes it easy for individuals and businesses alike to access and analyze information, enabling them to make informed decisions and drive success. Whether you're looking to explore new opportunities, identify trends, or collaborate with others, Rose.ai provides the tools and resources you need to achieve your goals. Discover the power of Rose.ai today and take your data analysis to the next level.

CharacterAI

Personality Insights and Predictive Analytics

500+ Openers For Tinder Written By GPT-3

500+ Original Conversation Starters

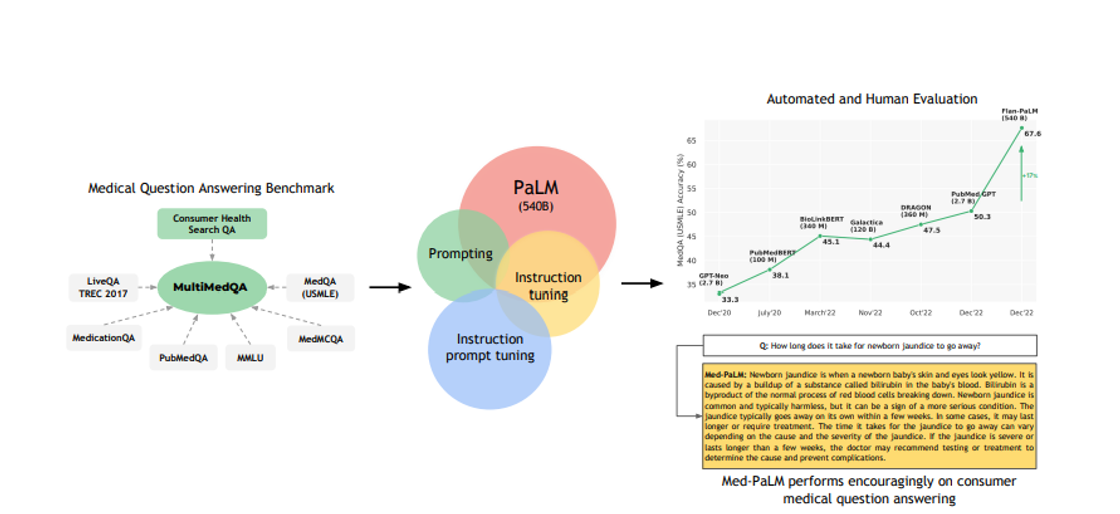

Med-PaLM

AI Powered Medical Imaging

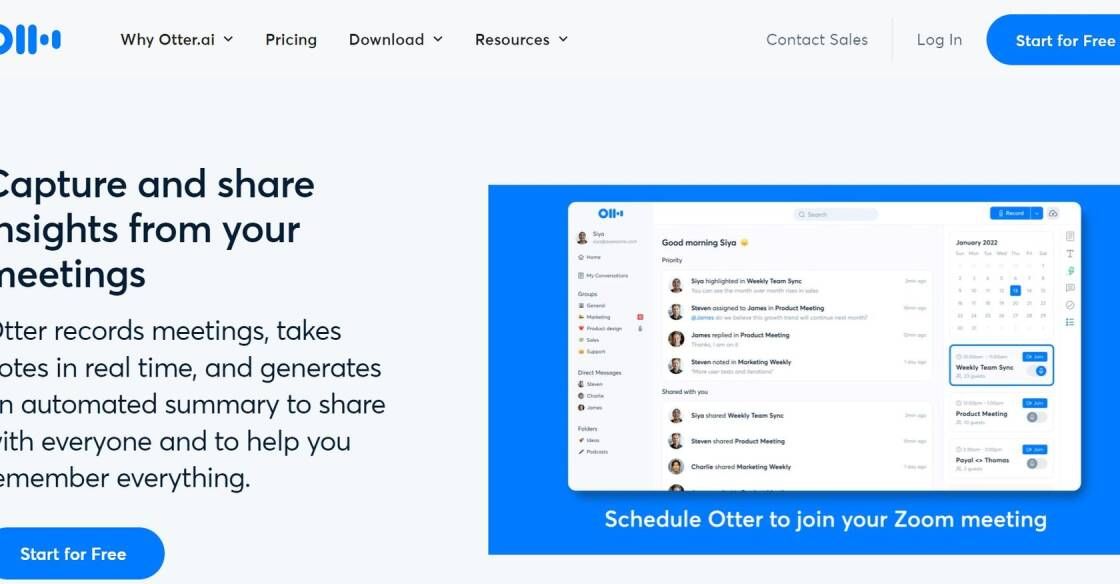

Otter AI

AI-Powered Transcription and Meeting Notes

Donotpay

DoNotPay - The World's First Robot Lawyer

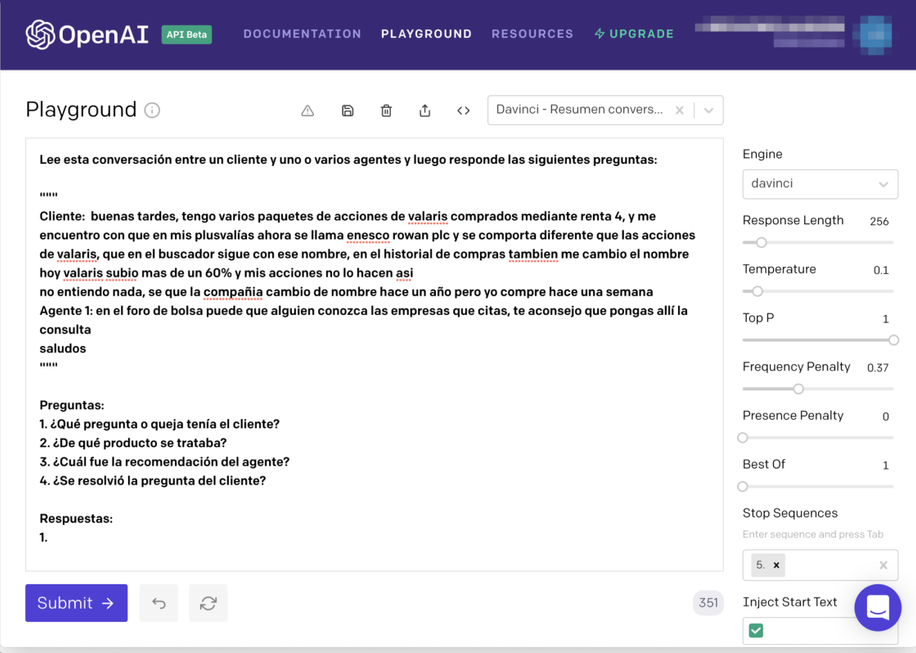

Spanish-speaking Banking Agent

Can GPT-3 help during conversations with our Spanish-speaking customers?

Topaz Video AI

Unlimited access to the world’s leading production-grade neural networks for video upscaling, deinterlacing, motion interpolation, and shake stabilization - all optimized for your local workstation.

Tome

The Future of Content Management

Fraudulent activities have become prevalent across various industries and have led to significant financial losses for businesses. The need to address this issue efficiently and effectively has given rise to the implementation of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML). Fraud.net, a leading provider of fraud detection and prevention solutions, offers AI and ML models that leverage deep learning, neural networks, and proprietary data science methodology to provide better insights into fraudulent activities for various industries. These industries include financial services, e-commerce, travel and hospitality, insurance, and many more. By using Fraud.net's AI and ML models, businesses can detect and prevent fraudulent activities in real-time, reducing their financial losses and overall risk exposure. With its cutting-edge technology, Fraud.net is at the forefront of the fight against fraud, empowering businesses to safeguard their interests and ensuring secure transactions for their customers.

Fraud.net is an AI and machine learning company that provides better insights to various industries such as financial services, e-commerce, travel & hospitality, insurance, and more.

Fraud.net uses AI and machine learning to analyze data and identify fraudulent activity in financial transactions.

Fraud.net's services can benefit industries such as financial services, e-commerce, travel & hospitality, insurance, and more.

Fraud.net uses a deep learning and neural network-based data science methodology to provide better insights to its clients.

Fraud.net's AI and machine learning models analyze large amounts of data to identify patterns and anomalies that can indicate fraudulent activity.

E-commerce companies can use Fraud.net's services to prevent fraudulent activity and protect their customers' personal and payment information.

AI and machine learning can analyze data much faster than humans can, making them more effective at identifying patterns and anomalies that can indicate fraudulent activity.

Other industries that can benefit from Fraud.net's services include healthcare, government, and retail.

Fraud.net's proprietary data science methodology and deep learning neural networks set it apart from other AI and machine learning companies.

Businesses interested in Fraud.net's services can contact the company for a consultation to determine how its services can benefit their specific needs.

| Competitors | Differentiators |

|---|---|

| Feedzai | Offers real-time risk management solutions for fraud prevention and detection. Utilizes AI/ML algorithms, behavioral profiling and entity resolution to identify fraudulent activities. |

| Kount | Provides a platform that uses advanced machine learning algorithms to identify and prevent fraudulent activities in multiple industries. Offers a wide range of fraud detection and prevention features. |

| Forter | Uses AI-powered fraud detection system, which provides real-time analysis of every transaction for malicious activities. Offers guaranteed fraud protection with zero liability for merchants. |

| Signifyd | Offers an end-to-end fraud detection and prevention platform, which uses machine learning algorithms and data sets to provide insights into fraudulent activities. Offers real-time transaction monitoring and chargeback protection. |

| Simility | Provides fraud detection and prevention solutions to banking, e-commerce, and financial institutions. Uses machine learning and data visualization techniques to identify fraudulent activities. |

| Sift Science | Provides a fraud prevention platform based on machine learning models that analyze user behavior and data to identify fraudulent activities. Offers real-time monitoring and alerting for fraudulent transactions. |

Fraud.net is a leading provider of innovative fraud prevention and detection solutions that leverage advanced AI and machine learning models. With an expertise in deep learning, neural networks and proprietary data science methodology, Fraud.net offers businesses across various industries with better insights to combat fraudulent activities.

The company's cutting-edge technology has been designed to cater to the needs of diverse industries, including financial services, e-commerce, travel & hospitality, insurance, and much more. Leveraging machine learning algorithms and artificial intelligence, Fraud.net delivers customized solutions that help organizations identify and prevent fraud, while also reducing false positives and minimizing risk exposure.

Fraud.net's AI-driven models analyze vast amounts of data, including a customer's behavioral patterns, historical and transactional data, social media activity, and other relevant factors to provide actionable insights. This enables businesses to stay ahead of the curve and detect fraudulent activities in real-time, thus eliminating potential losses due to fraudulent activities.

Moreover, Fraud.net's solutions are constantly evolving, keeping up with the latest trends and techniques used by fraudsters. The company's continuous efforts to improve its solutions result in better outcomes for its clients, who can rely on the platform to detect and prevent fraud effectively.

To sum it up, businesses across various industries can benefit from Fraud.net's AI and machine learning models, allowing them to stay ahead of the curve and safeguard themselves against fraudulent activities. With its advanced fraud prevention and detection solutions, Fraud.net ensures that its clients can achieve their goals efficiently while minimizing their risk exposure.

TOP