Discount is a Web3 portal to purchase discounted crypto and earn fixed returns for the mainstream. By leveraging interest rate derivatives, predictable returns in crypto are now possible. Play around with Discount Beta in Web2 fashion!

Introducing Notion E-wallet. Organize finances effortlessly. Log income, expenses and monitor your finance activities with ease. Created for anyone who wants to make their financial management better

In today's fast-paced and constantly evolving stock market, staying up-to-date with market-moving news is crucial for investors. With the advent of Babbl AI - an AI-powered stock market news and social media monitoring tool- keeping track of relevant news has become 100 times faster. By aggregating news from various sources such as articles, tweets, Reddit, etc., Babbl provides investors with sentiment analysis to gauge the mood and weigh the impact of bullish and bearish commentary surrounding each stock. This makes Babbl AI a valuable tool for investors looking to make informed decisions and stay ahead of the curve.

Keepertax is an innovative AI-powered tool that enables users to ask tax-related questions and obtain answers based on the most current tax changes implemented for 2023. With the capability to assimilate the US tax law and state and federal tax legislation changes since 2021, this free tool offers individuals a simple and reliable way to keep abreast of the latest tax updates. By leveraging cutting-edge technology, Keepertax offers a unique and user-friendly solution that streamlines the tax filing process, providing peace of mind and reducing the stress associated with tax obligations.

PinkLion is a groundbreaking platform for investors who want to make informed financial decisions. With the help of AI-based financial reasoning, PinkLion acts as an intuitive copilot to guide and assist investors in managing their investments. As a result, PinkLion can help both beginner and experienced investors make more informed decisions, backed by data-driven insights. The platform offers a variety of features that enable users to track their portfolio, monitor market trends, and access personalized investment advice. Ultimately, PinkLion aims to empower investors with the analytical tools and resources they need to succeed in the ever-evolving world of finance.

Konfio is a fintech company that provides AI-powered financial services platform to small businesses in Mexico. It offers an innovative solution that allows entrepreneurs to obtain small business loans without the need for collateral or paper processes. By leveraging the power of artificial intelligence, Konfio aims to democratize access to credit and facilitate the growth of small businesses in the country. With its user-friendly interface and streamlined process, Konfio has become a popular choice among small business owners who are looking for a quick and hassle-free way to secure funding.

Canva Text-to-Image

AI-Generated Graphics

CharacterAI

Personality Insights and Predictive Analytics

Remove.bg

Remove Background from Image for Free – remove.bg

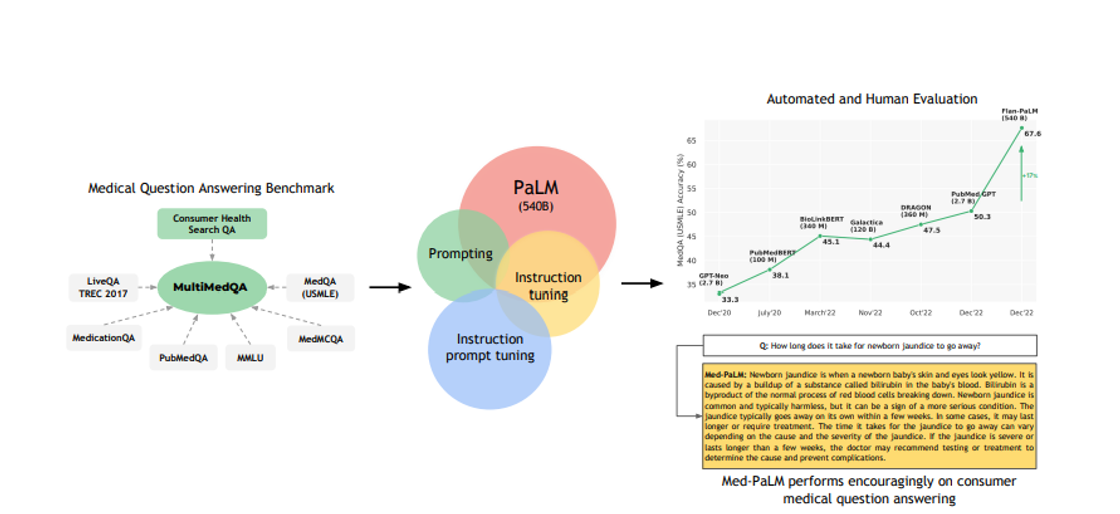

Med-PaLM

AI Powered Medical Imaging

FakeYou

FakeYou. Deep Fake Text to Speech.

Namelix

Business Name Generator - free AI-powered naming tool - Namelix

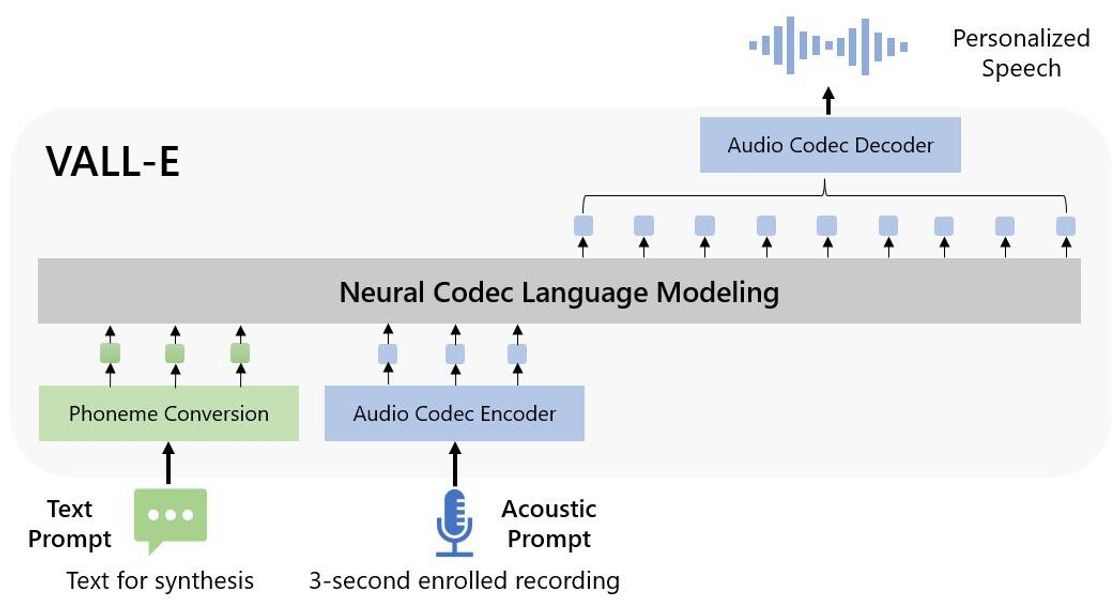

VALL-E

Robotics and AI for Manufacturing

AISEO

AISEO - AI writing assistant, Copywriting & Paraphrasing Tool

Fundera is a financial advisory and resource center that provides small business funding solutions to entrepreneurs. It is a platform that connects borrowers with lenders, offering a range of financial options such as loans, lines of credit, and equipment financing. Fundera understands the challenges that small businesses face when it comes to obtaining funding, and hence, it strives to simplify the process and make it more accessible for these businesses. The platform has a team of experts who provide guidance and advice throughout the loan application process, ensuring that entrepreneurs are well-informed and make the right decision for their business. Fundera also offers various resources such as business plan templates, financial calculators, and educational articles to help businesses improve their financial literacy. With its commitment to assisting small businesses, Fundera has become a trusted partner for entrepreneurs seeking funding solutions.

Fundera is a financial advisory and resource center that specializes in small business funding solutions. They offer a range of services such as loans, credit card processing, and cash flow management.

Fundera works with a network of lenders to help you find the right funding solution for your business. They will walk you through the entire process from application to approval.

While having good credit can certainly help, Fundera works with a variety of lenders who have different credit requirements. They will work to find a solution that fits your unique situation.

Fundera offers a variety of loans including SBA loans, term loans, lines of credit, and invoice financing. They will help you determine which loan type is best suited for your business needs.

No, the application process is simple and straightforward. You can apply online and receive a response in as little as 24 hours.

Fundera does not charge any fees for their services. They receive a commission from the lender if you are approved for a loan.

Yes, Fundera also offers services such as credit card processing, cash flow management, and accounting software to help you manage your finances.

The time it takes to receive funding depends on the lender and the type of loan. Some loans can be funded within 24 hours while others may take several weeks.

Each lender has their own set of qualifications, but typically you will need to have been in business for a certain amount of time and have a minimum annual revenue.

Yes, Fundera works with both established businesses and startups. They will help you find the right funding solution based on your business's unique needs.

| Competitor | Description | Funding Solutions | Key Features |

|---|---|---|---|

| Funding Circle | Peer-to-peer lending platform for small business loans | Term loans, lines of credit, invoice financing | Higher loan limits, faster funding time, no prepayment penalties |

| Lendio | Online marketplace for small business loans | Term loans, lines of credit, SBA loans, merchant cash advances | Personalized loan matching, wide range of lenders, fast funding time |

| Kabbage | Online lender offering small business loans | Lines of credit, term loans | Quick application process, flexible repayment options, no prepayment penalties |

| OnDeck | Online lender specializing in small business loans | Term loans, lines of credit | Quick approval process, competitive rates, dedicated account manager |

| BlueVine | Online lender offering financing solutions for small businesses | Invoice factoring, lines of credit, term loans | Fast funding time, easy online application, no hidden fees |

Fundera is a financial advisory and resource center that offers small business funding solutions. If you are a small business owner looking for financial support, Fundera can help you find the right financing option for your business.

Here are some things you should know about Fundera:

1. Fundera is an online marketplace that connects small business owners with lenders. They have a network of over 50 lenders, which means they can offer a range of financing options to small businesses.

2. Fundera offers a variety of financing options, including small business loans, lines of credit, equipment financing, and SBA loans. They can also help you find alternative financing options like crowdfunding.

3. The application process for Fundera is simple and straightforward. You can apply online and get prequalified in just a few minutes. Once you have been prequalified, Fundera will connect you with lenders who meet your specific financing needs.

4. Fundera is focused on helping small businesses grow and succeed. They offer a range of resources and tools to help small business owners navigate the world of finance, including articles, guides, and webinars.

5. Fundera is committed to transparency and fairness. They do not charge any fees to borrowers, and they are upfront about the costs and terms of each financing option.

Overall, Fundera is a great resource for small business owners who are looking for financing solutions. With their wide network of lenders and commitment to transparency, Fundera can help you find the right financing option for your business.

TOP